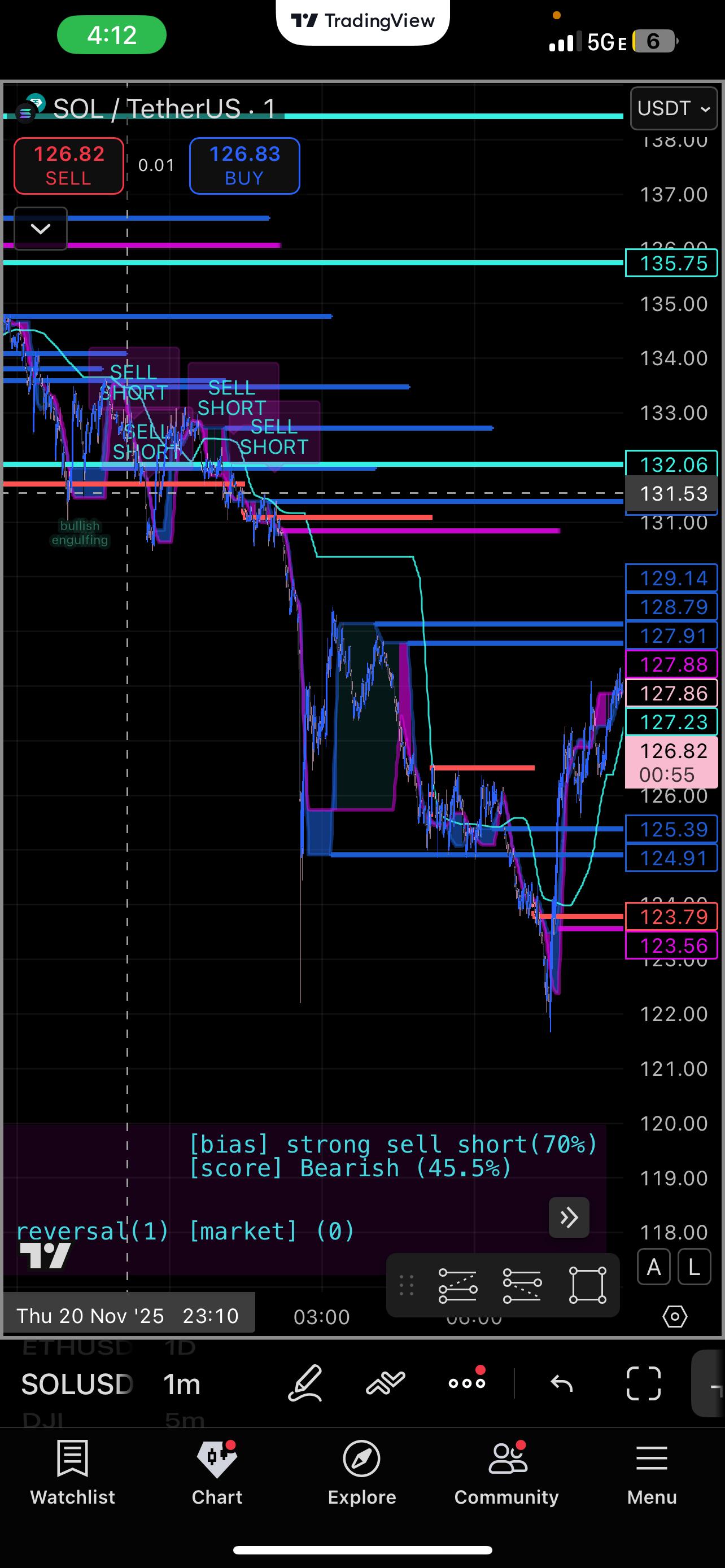

Real time market intelligence that predicts price direction

Predicting Market Movements with Advanced Military-Grade Pattern Detection

Proprietary predictive trading systems that profit across multiple assets

Our system detects systematic patterns in price data using advanced AI that we built in house

Multi-asset signal detection across crypto, equities, FX, and derivatives

Our models are designed to operate across multiple asset classes, enabling consistent pattern recognition regardless of market structure or instrument type

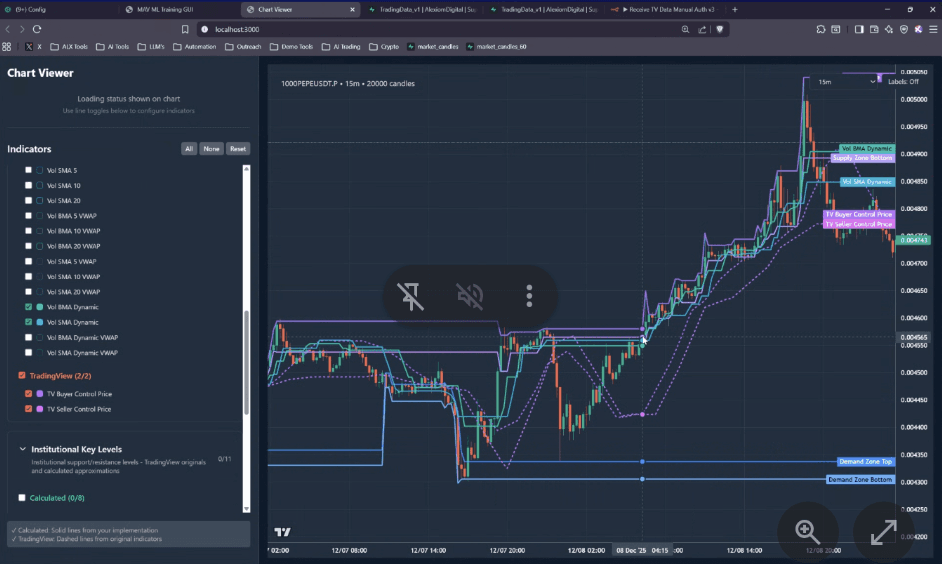

Real-time data ingestion and continuous model recalibration

The system processes live market data at frequent intervals, allowing predictive models to adjust dynamically based on observed performance and evolving market conditions

Research-driven methodology focused on statistical robustness

Our approach draws on decades of experience from founders with backgrounds at Google and in military analytical environments, where rigorous research and statistical validation are essential.

Research & Technology - Our Approach

We build adaptive trading systems by combining market research, statistical modeling, and continuous automation.

Step 1

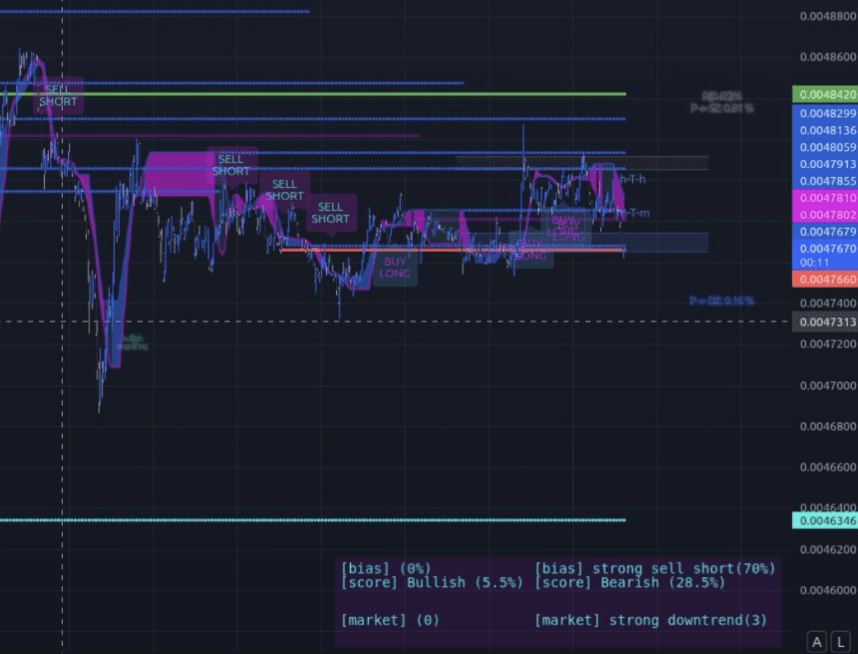

Continuous Market Analysis

We continuously monitor price, volume, and market structure across multiple timeframes

Step 2

Signal Generation & Scoring Logic

Pattern recognition logic and statistical validation, Signals are generated when multiple conditions align

Step 3

Automated Execution & Integration

Signals are executed automatically through our trading infrastructure. The system integrates directly with exchanges and execution venues via APIs, enabling seamless deployment across markets.

Step 4

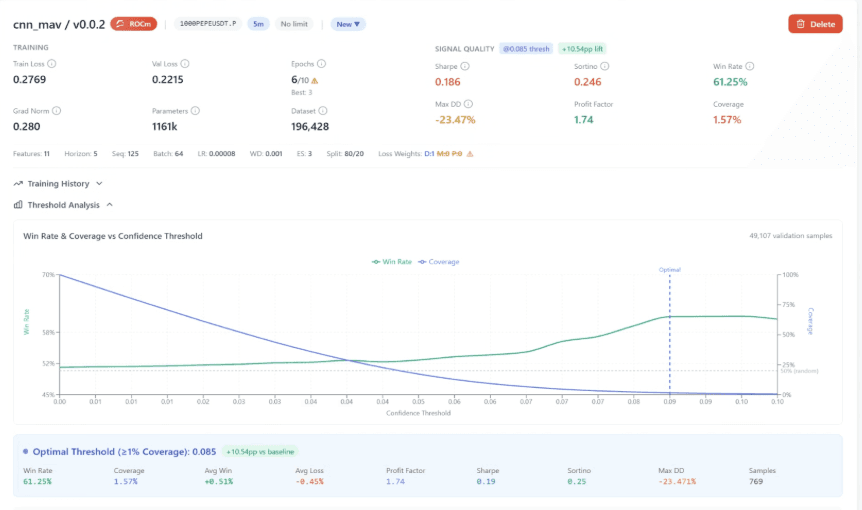

Continuous Learning & Optimization

All results are fed back into our data pipeline for analysis and model refinement. AI and machine-learning are used to optimize logic, improve pattern detection, and adapt to changing market regimes.

Performance - Live Trading

Our strategies are deployed in live market conditions, alongside an ongoing research process that uses backtesting to develop new approaches.

Invest with us - Partnership Model

How investors participate in QuantMav’s growth and long-term value creation, we'd love to hear from you.

We are seeking the smartest minds and strategic investors to help us scale

Get in touch with us, collaboration is key to growth